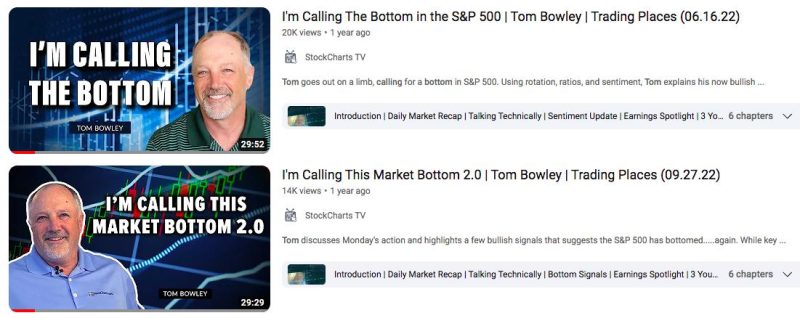

I’ve been bullish for nearly two years now. Bullish rotation and Wall Street manipulation started the latest leg of this SECULAR bull market back in June 2022. If you follow my research and work, then I’m sure you remember these two headlines on YouTube:

You can see that these two calls were in mid-June 2022 and late-September 2022. They weren’t the exact bottom, which occurred on October 13, 2022, but I’d say I was pretty darn close. And very few agreed with me at the time. That’s okay though, because my research is most important to me when I see things differently from everyone else. History has proven me correct and that’s what’s most important to me.

The bears don’t give in easily, however, as it’s always in style to think bearish thoughts. Pessimism runs wild in humans. It’s this pessimism that absolutely fuels bull markets.

Sentiment

Folks, the pessimism is just beginning to top and roll over. The 1-year (or 253-day) moving average of the equity-only put call ratio ($CPCE) has been unbelievably accurate in calling MAJOR bull market advances. It’s been calling for one again and it’s right again:

Sentiment plays a HUGE role in long-term stock market direction. The current secular bull market is likely safe for months, if not years, simply because the options world remains do pessimistic. Those same options traders were incredibly bullish at the end of 2021, just before our nasty 2022 cyclical bear market. Simply “put”, there were no more buyers. Everyone that wanted in was already in!

I can see a 5-6% pullback at some point in 2024, possibly even a 10% correction over the summer, but I’m confident we’ll end 2024 at all-time highs. The above CPCE chart is one big reason why.

Bullish Rotation

The bears have tried just about every excuse since mid 2022. Inflation and “Don’t fight the Fed” were two of my favorites back then. Then the bears morphed into “rallies are too narrow”, “breadth is weak”, and, of course, “it’s only the Magnificent 7!” Let me just say that the Magnificent 7 is the largest part of the SPY and QQQ, so if I could hand pick which 7 stocks I’d want to perform well, it would be those EXACT 7!

But I’d agree the best bull market is one in which we see wide participation. At EarningsBeats.com, we absolutely prefer seeing the rising tide lifting ALL boats. The rally since October 27th is the rising tide lifting ALL boats!

I’ve broken down the key S&P 500 rallies since the October 2022 cyclical bear market low. Check them out:

The red-shading shows the narrow strength in our 3 key aggressive sectors – XLK, XLY, and XLC. The green-shaded area highlights the WIDE participation in the rally off the October 2023 low. The red-shaded rally had leadership from 4 of the 5 aggressive sectors. The only one missing was financials (XLF). The green-shaded rally, however, shows ALL 5 aggressive sectors leading AND several other sectors not far behind. That’s the rising tide lifting ALL boats.

Top 20 Best Performers

Many of us (maybe all of us?) suffer from some form of recency bias. It’s easy to look at last week’s rally led by Meta Platform’s (META) blowout quarterly earnings report and believe it’s simply the Magnificent 7 doing their thing again. Last week was more than that, though. If we look at the stocks in the S&P 500 and NASDAQ 100, yes, META was the best performer and certainly did its share in lifting our major indices. But if you look at the Top 20 stocks (in the S&P 500 or NASDAQ 100) last week, you’ll see it was much more than META:

There’s a wide variety of sectors and industry groups represented on this Top 20 list. They won’t get equal air time on CNBC, though. You’ll hear how META and AMZN drove the market higher. That’s not a false story, but it’s an incomplete one.

I mentioned on several occasions last week how I believed that META and AMZN were going to report blowout numbers and they both came through. Check out their charts, especially their relative performance vs. their industry peers:

META:

AMZN:

I believe there’s a huge advantage heading into earnings IF a company is a leading stock within a leading industry group. I expect solid news from these companies and then it simply comes down to whether those strong results are already built into the stock price at the time of release. If not, we many times will see the type of reaction we saw on both META and AMZN.

I’m going to feature a company that reports this week in tomorrow’s FREE EB Digest newsletter. I wouldn’t be shocked to see a HUGE advance after earnings are released. I certainly expect numbers to come in ahead of Wall Street consensus estimates. If you’d like to take a look at this strong company, CLICK HERE to enter your name and email address, if you’re not already a FREE subscriber. There is no credit card required and you may unsubscribe at any time.

Happy trading!

Tom